September 2022 Update

Hello everyone! Hope you are all doing well.

I am writing this on a dreich Friday afternoon in Newcastle as I drink a cup of smelly tea (this is what the Mrs calls green tea alternatives) and I am contemplating putting my log burner on this evening to have a nice cosy night in front of the TV. I promise you, the last month has not been as boring as today might sound! Far from it and (as seems to be a common theme recently) unfortunately that means the budget has been tough reading this month.

Speaking of Scottish dialect (i.e. the choice of the word dreich), another word that the Mrs (who is Polish) picked up from my Scottish mother was the phrase “to flit” or “flitting”. My brother is moving house and my mum had said to the Mrs that she was going to help him flit at the weekend.

Anyway, back to the more serious (or exciting) stuff.

Living Life

As I was saying, we have had quite an eventful month.

A new lodger has moved in - a really easy going girl who is a similar age to us. So we have gone out to the pub / had food a couple of times with her which has been fun. So far it seems that we will get on really well and become friends over time. We still keep in touch with our previous lodger and I play squash with him on a regular basis (I have played with him a couple of times this month). Some of the perks of having a lodger - it means you make new friends.

My friend got married and I was the best man so we had a lot of fun ceilidh dancing and had quite a few drinks. I actually overdid it a little the night before the wedding so the groom needed to give me a bit of a pep talk (instead of the other way around) on the day of the wedding - I like to think it was a good distraction. The wedding was lovely and was in an old barn in the middle of the Scottish countryside. I think my speech went well - I am somewhat lucky as I need to do quite a bit of public speaking at work. Unfortunately the same probably cannot be said for the father of the bride - I think he felt the pressure a bit.

To end the month we had a trip to Belfast for a couple of nights. We did a walking tour around the city and learned about the history and politics that dominate Belfast’s past. We also went on a bus tour along the Northern Irish coast with the highlight being the Giant’s Causeway. And last but not least, we had to try out some of the pubs in the city - some really great old pubs with lots of character - our favourite was the Crown Liquor Saloon (originally a Victorian gin palace which still has gas lighting inside - read more here). We had a great trip.

Spending

Similar to last month, we have spent a fair wee bit…

The wedding and trip away have obviously impacted our budget this month but we have also had to get some work done by a plumber in the house (replacing a tap) and had the gutters cleaned out. The joys of being a home owner! It is also the Mrs's birthday at the start of next month so I have spent a little more on gifts this month (needs must eh! :D).

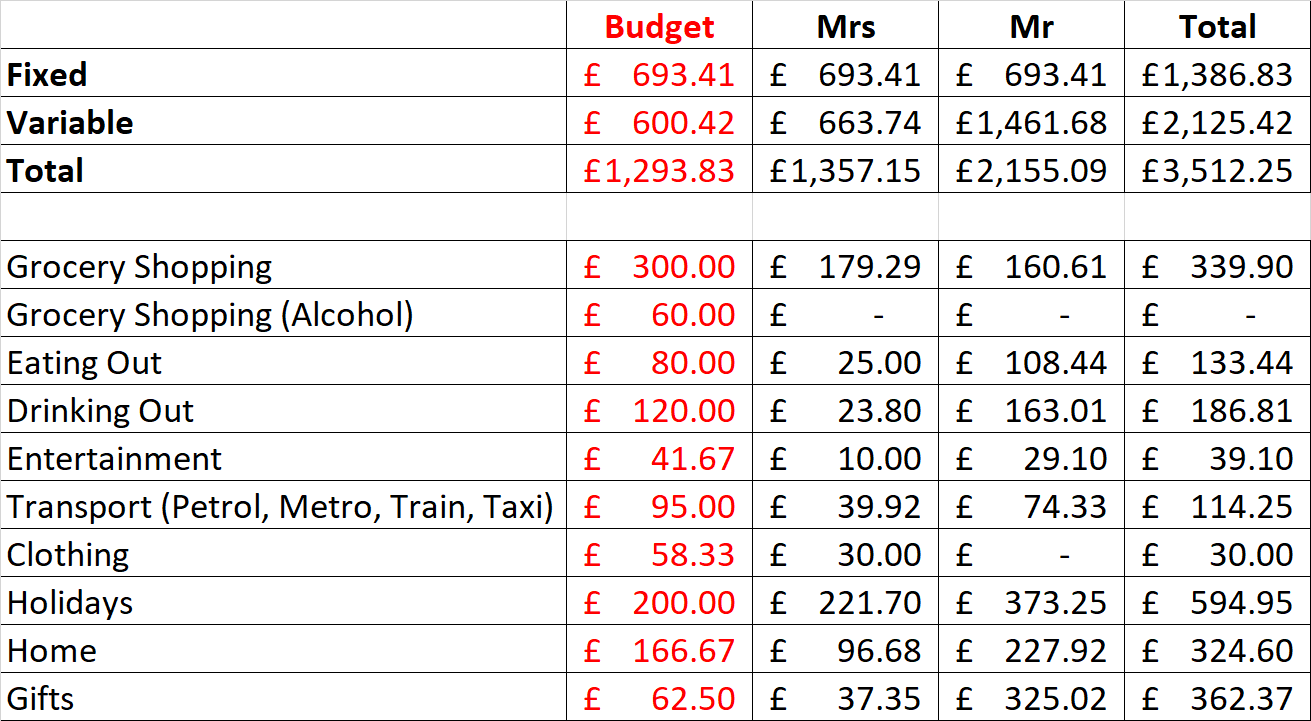

As usual, the tables below show the spending for this month. We were 36% over our target budget this month.

The budget shown in graphical format can be seen below. The same as last month, the gap is widening between the budget and our actual spend.

FI Fund

As for the FI fund, this has been impacted by the market turmoil this month again so we are slightly down. Staying power is the game during these tougher times - investing is a long game!

As usual, I include my total net worth in my FI fund. At the moment, the FI fund (our total net worth) is currently £320,890.31 which is down £6,212.49 from last month (or 1.9%).

Our FI target is £800,000 currently (although this might have to change given the overspend we are seeing in our budget) so I track my FI fund in relation to this number.

I track it by splitting my FI number progress into bars where each bar represents achieving freedom for each respective month of the year (i.e. the FI number is split into 12 each parts). Therefore, this month suggests we have reached 4.8 months of financial independence each year.