Why government bonds might be a good investment now

Hi everyone. Two blog posts in quick fire this week!

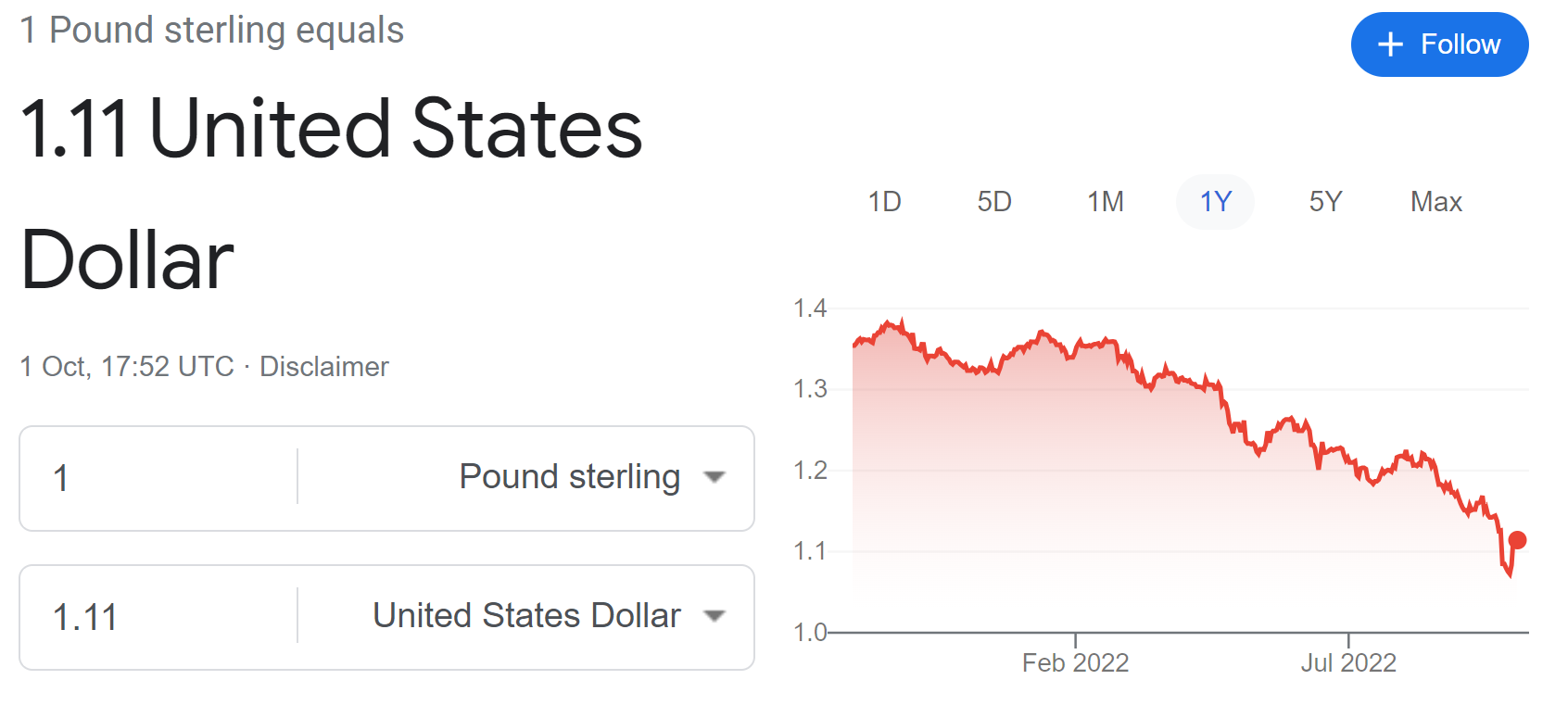

I wanted to write up this post as it is quite timely due to the recent unprecedented swings we have seen in the UK government bond and currency markets. The pound sterling has weakened severely when compared to the U.S. dollar and the U.K. government bond market has seen some significant volatility to the downside (i.e. yields rising).

This reportedly almost resulted in some pension funds having serious liquidity issues which subsequently resulted in the Bank of England (BoE) taking urgent action. The BoE has therefore effectively committed to buying long term government bonds at a rate of up to $5 billion a day for the next 13 weekdays, in an attempt to restore proper market functioning.

Since the announcement, the Gilt fund “GLTL” has rallied approx. 24%! And everyone thinks government bonds are boring eh. 24% in a few days - that’s not normal.

What this says to me is that the stress within the financial markets is starting to flare up. It doesn’t mean we are at the peak of the sell off in the equity market but it shows that the significant sell off we have seen in the bond market is starting to result in severe problems. Government bonds are meant to be a safe investment after all.

Why would government bonds be a good investment now?

So I hear you ask, why would I buy government bonds at a time when they seem to be as volatile as they have ever been? Also at a time when inflation is really high and interest rate rises don’t look like they are slowing down?

These are reasonable questions but I have an alternative view. Inflation will not last indefinitely and central banks will not increase interest rates forever. Every interest rate hiking cycle eventually ends with central banks cutting rates. The playbook is normally to keep hiking rates (and tightening monetary policy) until something breaks. Once that objective has been achieved (e.g. once unemployment starts to increase), central banks will start the expansion phase again - cutting interest rates and printing money. Every cycle has the same headlines which portray the mantra that “this time is different” - I am not sure it will be.

Government bonds are normally seen as the best hedge to investing in stocks. Essentially government bonds are “risk off” assets and stocks are “risk on” assets. However, in 2022, we have seen both stocks and government bonds both sell off at the same time - with government bonds undergoing one of their worst sell offs in history. For example, U.S. government 10 year treasury bond yields have reached almost 4% when compared to reaching almost 0% during the 2020 COVID crash - surely at these rates government bonds are starting to become more attractive?!

As I said previously, government bonds are normally the best hedge against stock market downturns. If you take the fund “TLT” (i.e. long term U.S. government bonds), in the run up to the COVID crash in 2020, this fund rallied approx. 55% from November 2018 to April 2020. Another example would be the Great Financial Crisis, the same fund rallied approx. 40% from June 2008 to December 2008. At the same time the fund “SPY” (i.e. the S&P500) dropped by approx. 10% and 35% respectively.

Now, the difficulty here is timing. You are unlikely to absolutely maximise the returns due to not being able to time the market perfectly. The aim is to hedge your equity during times when the risk of a significant market downturn is heightened.

The stock market (if you use the S&P500 as a measure) has already seen a relatively significant downturn in its own right (approx. -25% year to date). However, given that central banks are still continuing to hike and tighten monetary policy, I suspect we may not have seen the worst of it just yet. Stock markets don’t normally bottom until central banks start easing again. That doesn’t mean to say stocks cannot rally first before eventually going lower.

Is inflation really going to come down?

Most are not convinced that inflation will come down. We have seen energy prices increase to significant levels and everyone has become scarred by this (particularly in Europe).

A big driver of inflation is the Russia / Ukraine war. Effectively this has resulted in significant constraints in the food and energy markets and, as a result, increased the prices of goods globally. However, we must remember that the war will not last forever and hence these pressures will ease eventually.

Otherwise, there have been some indicators which would suggest inflation is starting to cool down. Examples would be the Copper index fund “CPER” - this fund as dropped approx. 33% since March 2022. Copper is an important metal due to its use across a number of sectors and hence it is seen as a leading indicator of economic health. Another example would be the costs of shipping from China - these are indicating weaker demand for goods as they have dropped back to 2020 levels. Nike announcing that their inventory is “overstocked” would suggest similar.

Other than these indicators (and many alike), the yield curve (represented by the inverted 10year minus the 2year treasury bond yield curve) is suggesting that we are either in or about to embark on a recession and hence a significant fall in economic growth. Recessions (as a result of a drop in demand) are normally also deflationary.

Will interest rates continue higher for longer?

There has been some work done that relates demographics as being the key driver to increases or decreases in global interest rates over the long term.

I won’t get in to too much detail here but I suggest you read this paper written by the BoE in 2017 - link here.

In this paper, they have developed an economic model which has been calibrated on previous data. Essentially their conclusion was that global demographic change can explain a significant proportion of the drop in global real interest rates since 1980. They also suggest that the sign of these effects will not reverse as the baby-boomer generation retires. They expect that demographic change will reduce rates further by 2050.

Summary

Given all of the above, I have the following summary of arguments to invest in government bonds at this time:

Government bond yields have increased to more attractive levels.

Central banks (e.g. U.K.) are willing to step in to stabilise the bond market (i.e. cap the downside).

Central banks are still tightening monetary policy which normally results in an unstable period for the stock market - potentially resulting in a more significant sell off.

Government bonds are a “risk off” asset and normally provide the best hedge to stocks. Having cash to deploy during a stock market downturn is a very useful asset.

Inflation indicators are showing that inflation has started cooling off and that a recession is now the biggest risk.

Long term demographic trends suggest that interest rates are expected to stay lower for longer.