August 2022 Update

Hi everyone, hope you are all doing good!

This month has been a busy one again. Filled with lots of good times but that also comes with some additional spending. It is Summer after all. You need to make the most of it.

Living Life

As I say, the last month has been full of great stuff and spending quality time with the Mrs and friends. Some of the highlights were:

A friends 40th (Newcastle) at a local brewery

and a friends 30th (London) at a BBQ in London

Dips in the sea and eating food / drinking down the beach

Cycling around the local area

Hiking Hellvelyn in the Lake District

I have to be honest, it was filled with quite a bit of drinking and spending money without much control over the budget. Tut tut…

Spending

As I was saying, we did spend quite a bit this month. This was also made worse by the fact that we bought a surveillance camera (for the side of the house) and a doorbell (which also has a camera). We also did some electrical works in the house - fixing a faulty light switch along with some other bits and bobs (like adding another plug socket).

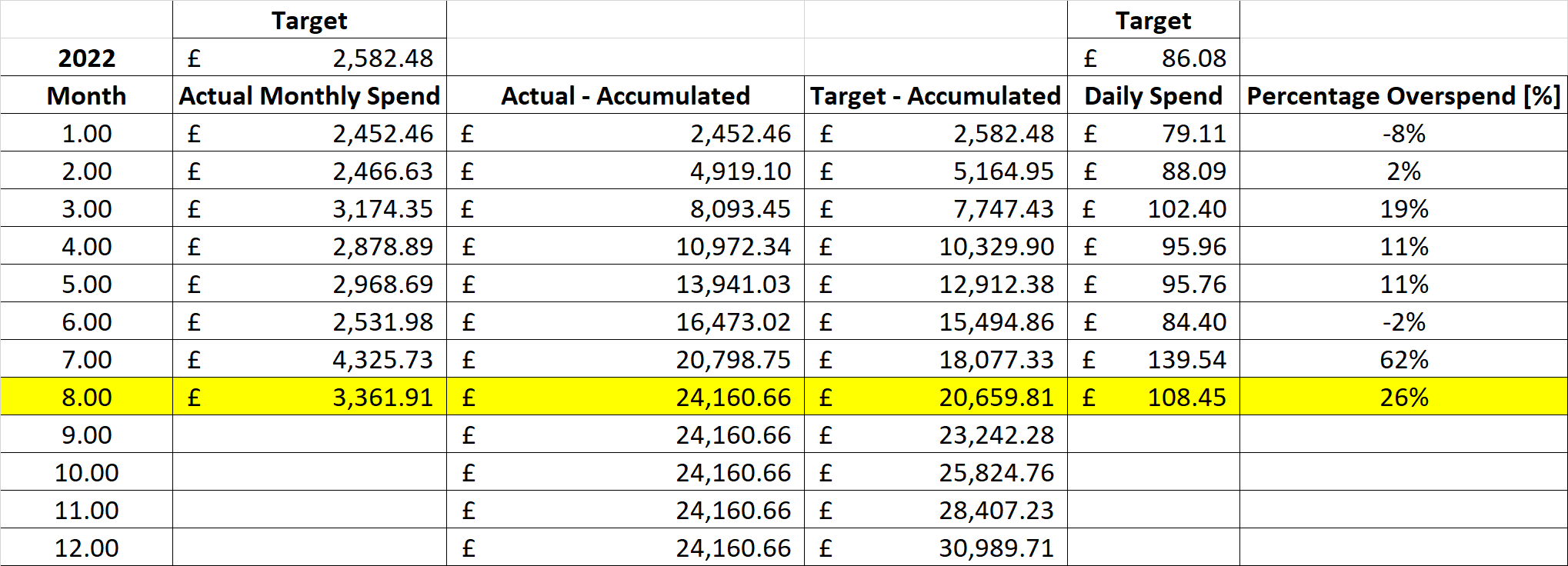

The tables below show the spending for the month. We were 26% over our target budget this month! Not too great.

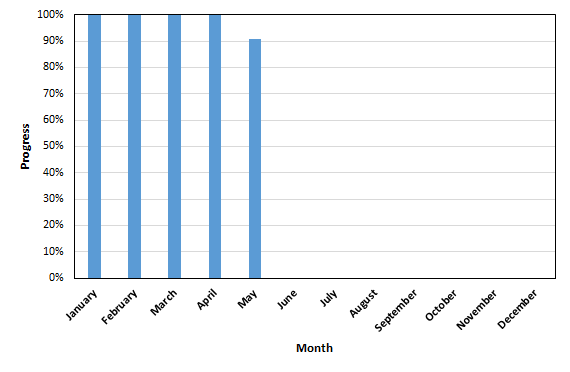

I also track the budget in graphical format (easier to look at). The plot is shown below. As you can see, the budget is running away from us a little. We hope the winter period brings us back to a more reasonable overspend… Let’s see.

FI Fund

The FI fund. Let’s see how we are doing on that front!

This might sound a bit strange but I include my total net worth in my FI fund. This is mainly because the assumption would be that I could sell my house and then look to rent for a period of time. We (the Mrs and I) would like to travel so an option would be to spend 6months renting in different countries at the beginning of our financial independence journey.

The FI fund (or our total net worth) currently stands at £327,102.80 which is £11,994.78 (3.8%) higher than the last time I updated in July.

We have a target of reaching £800,000 so I also track my FI fund in relation to this number.

Therefore, I find it useful to track my FI number in terms of progress bars where I split the FI number into equal 12 month bars. Each bar represents achieving financial freedom for each respective month of the year. So far we have been able to achieve a potential 4.9 months of financial independence each year.