April, May & June 2023 Update

Apologies everyone, I have gone MIA the last few months - we can get into why in just a minute. Hope you have had an epic time without me anyway!

Living Life

April, May and June have generally been very good. The better weather allowed the Mrs and I to make use of our nice garden by getting out to have dinner and drinks in the sunshine at every opportunity. We managed to go on a few hikes locally and I went on a hike at Ben Lomond with a few friends. Finally, I went on one of my really close friends’ stag do in Dublin which was great (although did take it out of me!).

Other than general living, we spent a lot of time pulling together the final pieces of our wedding day - which, as I write this, has now taken place. I will write a follow up blog telling you all about it (and the numbers :D).

Other than the fun stuff, I found out recently that I have a B12 deficiency which means my body is not absorbing B12 efficiently - this could have resulted in a number of health problems so I am glad I caught it (good website if you want to find out more). So far (after some treatment) I am feeling much better. Following this, I have started being a lot more health conscious.

Spending

As seems to be the case this year, April, May and June were a bit more spendy than we would like. Maybe it is partly due to us being in the run up to our wedding and wanting to enjoy things more - although I have split out the wedding spending separately.

In summary, we spent the following:

April = £3,947.43 (29% over daily budget)

May = £3,394.30 (7% over daily budget)

June = £3,361.12 (9% over daily budget)

And in the graphical format below ;).

FI Fund

Since March, the stock market has performed well - the S&P500 for example is up approx. 15%.

As for my investing, considering the yield curve is still significantly inverted, I have continued adding only to government bonds. My views on the market have not changed. Government bonds also continue to hold up relatively well since they bottomed last October.

The FI fund includes our full net worth as usual. At the moment, this is sitting at £375,041.35 which is up £23,094.41 (or 6.56%) from March. Again, we are making new all time highs!

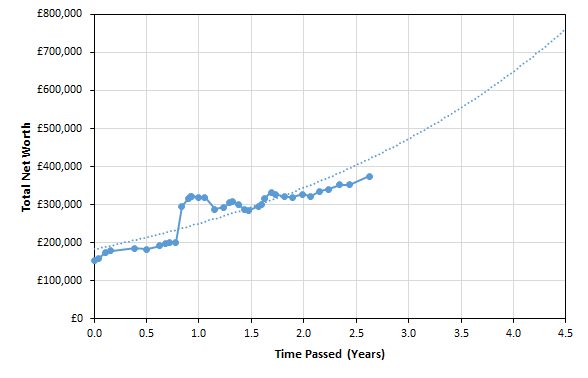

Again, we have looked at our net worth in a slightly different way - this was inspired by the Mad Fientist.

This helps us visualise the trajectory towards FIRE based on current monthly spending and investing habits. Let’s hope FIRE is achievable at some point in 2027 / 2028.

The graph has the following assumptions:

Income from investments (post-FIRE) = 4%

Monthly savings / investments = £3,000 per month

Return on investments (pre-FIRE) = 7%

If you have read my blog post updates before, you will know we normally track our FI target against a milestone of £800,000.

We track the £800,000 number by splitting it out into equal bars where each bar represents achieving financial freedom for each representative month of the year. Therefore, this month suggests we have reached just over 5.6 months of financial independence each year.