2023 EOY Review

Hello and welcome back! Merry Christmas - I hope you are all enjoying your festive break. I have certainly tried to put my feet up. It has been a long, eventful year and apologies for not being very active on here. Sometimes life gets in the way.

For those of you returning readers, thanks. I know my blogging is a bit haphazard but I do enjoy it when I get the chance to update you all.

Living Life

Since I last posted in June, it has been a whirlwind I have to say. I got married to the love of my life and had an amazing day celebrating it with close friends and family. We made a weekend of it and invited our closest family to our house for a BBQ the day before (some from as far afield as Poland and Australia). It really was great to be with good people and just enjoy the lucky weather we had.

Following our wedding, we went to a friends wedding in London where I was best man - one of my long term mates from school. We had an amazing time. Not long after that we then embarked on our epic honeymoon (well, you could say “Part 1” of our honeymoon - read on for more) to the USA.

“Part 1” of our honeymoon in the USA started in Los Angeles where we visited Rodeo Drive, Beverley Hills, Santa Monica pier, Venice beach, Hollywood walk of fame, Griffith observatory and saw Van Morrison live. We then travelled to Las Vegas where I played some poker (and managed to win $800 :D) and we saw Foo Fighters. The trip then went from epic to being even more epic when we went on a road trip through the national parks - Yosemite and Sequoia (our favourite part). We then spent a few days in San Francisco doing all of the touristy stuff - Golden Gate boat tour, Fisherman’s Wharf, painted ladies, eating clam chowder, etc. before flying to New York where we ended our trip. A really amazing trip that we will remember for a long time.

“Part 2” of our honeymoon was a lucky roll of the dice. The day before I went on my honeymoon I found out that my work wanted me to go to Japan on a work trip. So since this would be the opportunity of a lifetime, the Mrs tagged along with me. We visited Tokyo and Kyoto. I was so impressed - particularly with Tokyo. Both of us agreed that although the USA trip was epic, Tokyo topped it for us. The city is just so vibrant with so many different areas to visit. The main areas we visited were: Asakusa, Shibuya, Shinjuku, Ueno, Ginza and Roppongi. Kyoto is really cool too - we went to the Gion area, Bamboo forest, Nara and the Fushimi Inari Temple.

If you ever are looking to visit any of these places, please leave a comment and I would be more than happy to give some recommendations.

Lastly, although this time not with the Mrs, I visited Zurich in Switzerland with work. We had an event at a hotel up in the mountains - that was really cool.

So as you can imagine, the last 6months or so have flown by. I am now sitting in my living room relaxing with the fire following Christmas day at my parents house a bit lost for words with how amazing a time in my life it has been. Next year, the reality of January is likely going to hit hard!

Spending

The last 6months has been relatively “spendy” but work paid for part of the Japan trip and I have kept our wedding spending separate. I need to try and write a blog post on our wedding spending at some point - we have tracked it (spoiler - we likely spent about £20k).

In 2022 we spent £36,862.07 and this year we have blown that out of the water - spending £42,205.40. This is 14.5% higher than last year. Obviously inflation has been raging and we have been fairly active with pretty extravagant holidays so I am not surprised. Although it goes against the overall goal of achieving FIRE, sometimes you have to enjoy the best moments in your life and take advantage of opportunities of a lifetime.

This year our average monthly spend was £3,517.12.

FI Fund

The markets have been rallying pretty hard of late - for example the $SPY ETF (S&P500 tracker) is up 25.13% year to date as I write this. I know I have probably been “Mr doom and gloom” for a while and potentially missed out on some additional upside (due to increasing my allocation in government bonds) but I do feel strongly that not all is as good as it may seem. I expect cuts in interest rates (now being forecast in the US as early as March) to result in potentially significant downside in the market. The yield curve has been inverted for a long time now - normally a pretty accurate recession forecasting indicator. Following the recent rally recently, I took the opportunity to take more profits in my equity position and add more to my US government bond allocation.

The FI fund includes our full net worth. The recent upside in the market combined by our commitment to continue aggressively adding to our portfolio has resulted in our portfolio doing very well this year. Currently, it is sitting at £411,225.12 which is £89,562.65 higher (or +27.8%) when compared to last year at the same time (£321,662.47).

As a summary, here is a record of our net worth over the last 3 years (nice to see the progress):

December 2021: £319,152.82

December 2022: £321,662.47

December 2023: £411,225.12

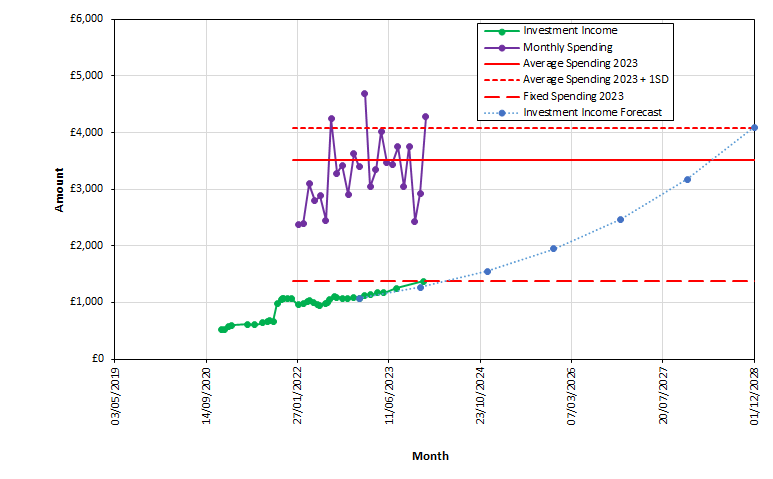

Inspired by the Mad Fientist, we track our net worth slightly differently. This helps us visualise the trajectory towards FIRE based on current monthly spending and investing habits.

The graph has the following assumptions:

Income from investments (post-FIRE) = 4%

Monthly savings / investments = £3,000 per month

Return on investments (pre-FIRE) = 7%

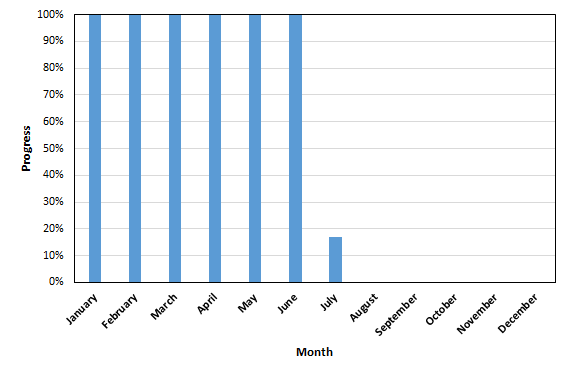

Also, as another way of looking at it, we break our FI milestone (an arbitrary £800,000) into 12 equal bars to track our progress against that. Each bar indicatively represents achieving financial freedom for each representative month of the year. Therefore, we are currently sitting at 6.2 months of financial independence each year.

Overall, this year has been a good one but it means nothing if we cannot keep up the momentum. Let’s hope next year is just as fruitful. Whether the markets are up, down or sideways, I plan on continuing to invest aggressively. It is nice to be motivated by a good year like this one.

I wish everyone a successful 2024 and beyond!