March 2023 Update

Woosh and now March is finished! Time just seems to be flying past these days. I have to say though the sunshine is making me a lot happier. It is amazing how much better it can make you feel.

Living Life

March has been a fun packed month. I went to Edinburgh a couple of times - once to do some whisky tasting with my brothers and dad and once with my brothers again to watch the football.

But the biggest event this month was my stag do! I am actually slightly delayed in writing this as I am still in bits recovering - thankfully the Mrs’ sister made an amazing Easter lunch to help get me back on track. I have to say, my brothers and mates really went the extra mile - don’t think I paid for one drink for the whole two days.

Spending

March was a bit spendy again but then again you have to enjoy yourself a bit sometimes. We had another pretty big one off payment too - the car needed some repairs so that was about £400.

So we were slightly over budget. Overall we spent £3,266.83 which was 3% over our target daily budget.

And in the graphical format below ;).

FI Fund

March has continued the sideways movement in the stock market. As for my investing, I have continued adding only to government bonds. Similar to last month, my outlook on the stock market is pretty bleak. I am of the opinion that we will continue to see more downside over the next 6months or so. I still see government bonds starting to outperform - $TLT (long term US government bonds) are up ~15% since they bottomed last October.

The FI fund includes our full net worth as usual. At the moment, this is sitting at £351,680.06 which is up £11,100.38 (or 3.26%) from last month. Again, we are making new all time highs!

We were fortunate enough to get a hold of a decent amount of cash this month which has helped propel the portfolio.

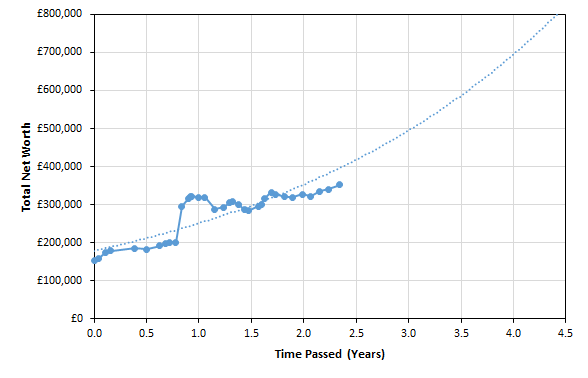

Again, we have looked at our net worth in a slightly different way - this was inspired by the Mad Fientist.

This helps us visualise the trajectory towards FIRE based on current monthly spending and investing habits. Let’s hope FIRE is achievable at some point in 2027 / 2028.

The graph has the following assumptions:

Income from investments (post-FIRE) = 4%

Monthly savings / investments = £3,000 per month

Return on investments (pre-FIRE) = 7%

If you have read my blog post updates before, you will know we normally track our FI target against a milestone of £800,000.

We track the £800,000 number by splitting it out into equal bars where each bar represents achieving financial freedom for each representative month of the year. Therefore, this month suggests we have reached just over 5.3 months of financial independence each year.