January 2024 Update

Hi everyone - January is finally over! But, it wasn’t all that bad was it…

The time of year that makes or breaks your new year resolutions. I certainly cannot say that have been able to make much of an impact yet. A big one for me was to try and be more active - I went for one run and played squash a couple of times but I think I need to do a bit more than that!

Anyway, let’s get into it.

Living Life

OK, so as you will imagine, January has largely started slow but there has been a few exciting things going on.

Our lodger moved out and we completely gutted and cleaned the room - it is far less stressful now. We also have a new lodger who will be moving into the room in a couple of weeks - nice, clean (even said he would help with chores), quiet guy.

My brother and his wife are having a baby (shhh, it is still top secret). I am over the moon for them. I think my brother is still in shock but he will make a great Dad. It puts the pressure on the Mrs and I as to when we are going to have kids - they are a little younger than us. We also managed a meal and a night out with him and my parents for his 30th birthday which was great.

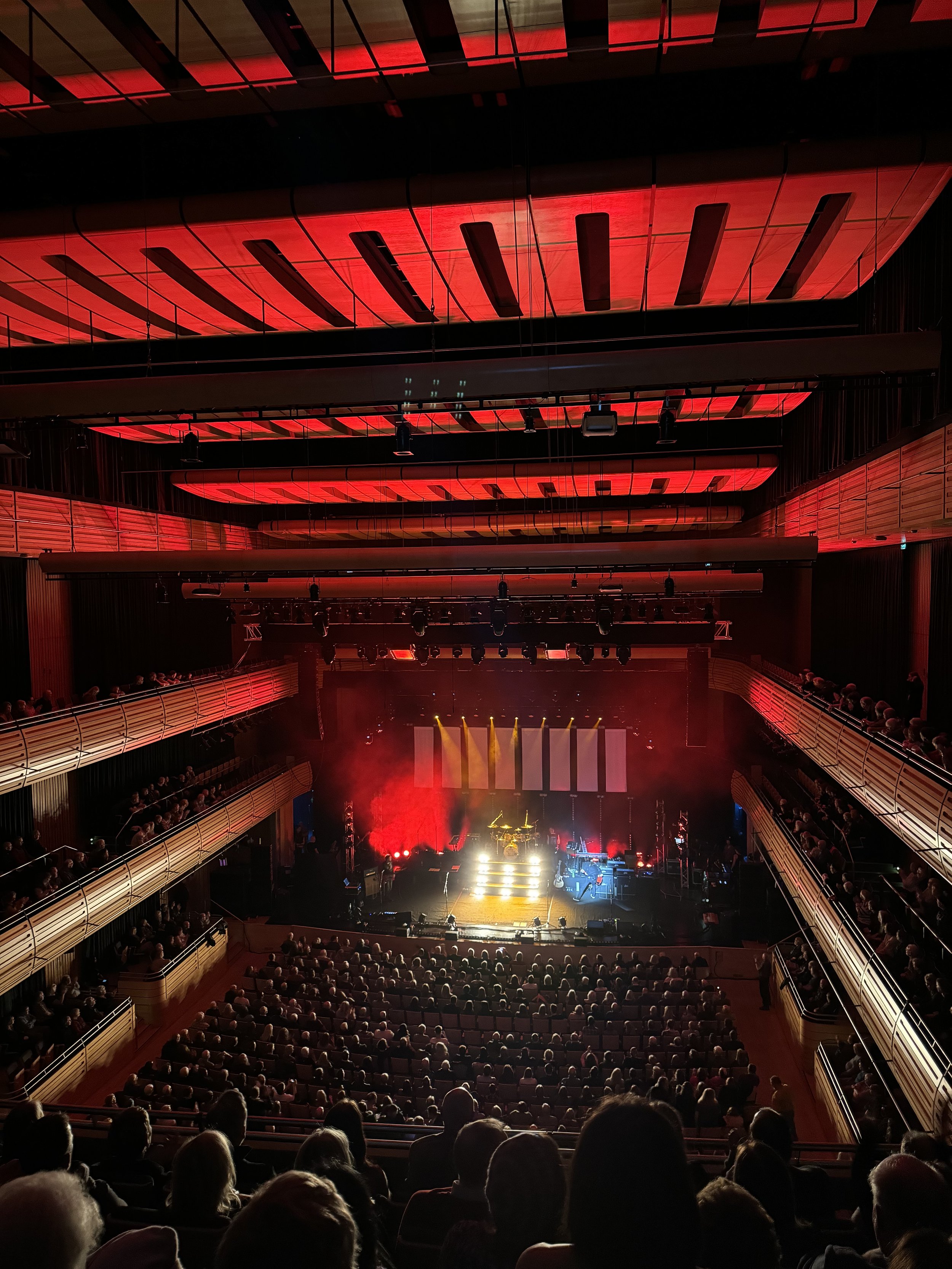

As part of my Christmas present, the Mrs took me to a great gig called “The Classic Rock Show”. I have to say the demographic was a little older but the music was epic. They nailed so many epic rock classics - an evening well spent. Prior to this we also had an amazing steak platter at Tomahawk in Newcastle - another one of my Christmas presents.

Spending

As seems to be a regular theme, we are over budget this month. But this month does have a few birthdays including my brothers 30th so that will have contributed. We also needed to get the break discs replaced on the car and the Mrs wanted some mural wall paper for the bedroom - all adds up. So this month we spent £3,987.55 which is 10% over our revised target.

I will add in the tracker charts again from next month.

FI Fund

The market rally has continued on in January with the $SPY ETF (S&P500 tracker) up 4.59% year to date already.

Again, if you read my previous blog posts, you will see that I continue to add to my government bonds position (specifically US government bonds) as I feel the market is a little risky just now with the yield curve being inverted. Although, I did add to my £SMT (Scottish Mortgage Investment Trust) position recently in my general investment account.

The FI fund includes our full net worth. This month, we are up again at new all time highs! The portfolio is sitting at £422,186.19 which is £10,961.07 higher (or +2.67%) when compared to the last update.

Inspired by the Mad Fientist, we track our net worth slightly differently. This helps us visualise the trajectory towards FIRE based on current monthly spending and investing habits.

The graph has the following assumptions:

Income from investments (post-FIRE) = 4%

Monthly savings / investments = £3,000 per month

Return on investments (pre-FIRE) = 7%

Also, as another way of looking at it, we break our FI milestone (an arbitrary £800,000) into 12 equal bars to track our progress against that. Each bar indicatively represents achieving financial freedom for each representative month of the year. Therefore, we are currently sitting at 6.3 months of financial independence each year.