April 2024 Update

Hi everyone - how is everyone doing? This month someone got stabbed in London with a sword and Humza Yousaf stepped down. And, have you seen Baby Reindeer?!

Living Life

This month started with a week away to the Lake District where we stayed in a lodge complex with our own kitchen but also a swimming pool and things. We were with the Mrs’s sister and kids so we didn’t do too strenuous hiking but did Cat Bells and walked back to Keswick which was a nice little one for the kids.

Other than that, I have continued to hone in my curry cooking skills. I have caught the bug since our Indian lodger taught me some basic tricks. Maybe I should share some of the recipes because I think the taste is amazing and something I could never have done without learning a few things from him.

Lastly, I started a Facebook group called “UK FIRE Content” which currently has 117 members. Lot’s of great people on there and the hope is that the community continues to grow and we talk all things FIRE - see you there!

Spending

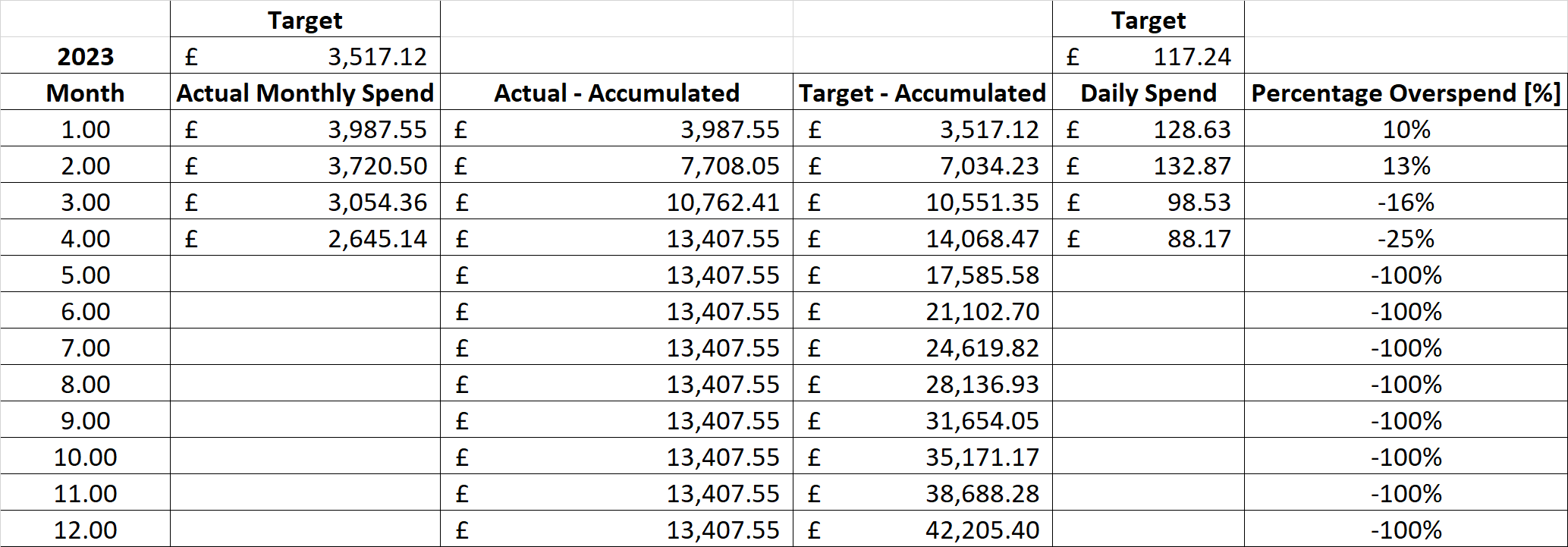

Wow, this month shocked me in a good way! We were under budget again and we are actually under budget year to date also. Which is surprising as we did have a week in the Lake District. That said, we did cook a lot in the lodge so that saved us.

This month we spent £2,645.14 which is 25% under our budget. Oh yeah!

FI Fund

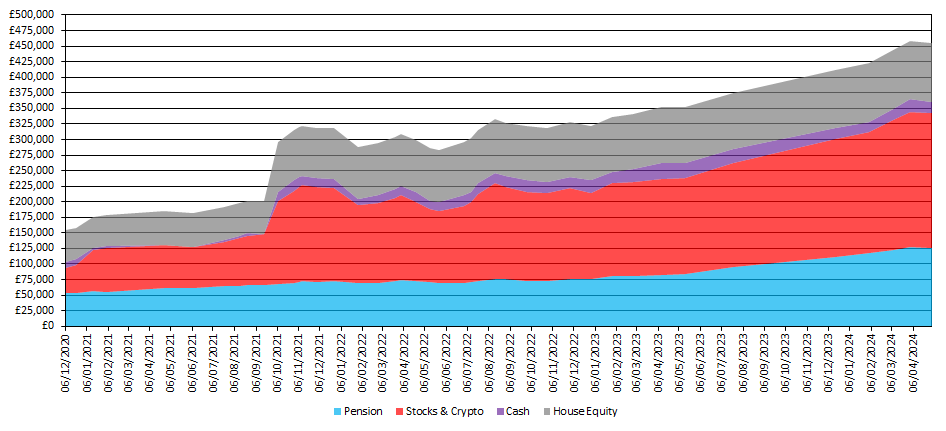

This month the markets have had a little bit of a wobble so this has hit the FI fund slightly.

The FI fund includes our full net worth. This month the portfolio is sitting at £455,621.20 which is £2,760.03 (or 0.6%) lower than when compared to the last update.

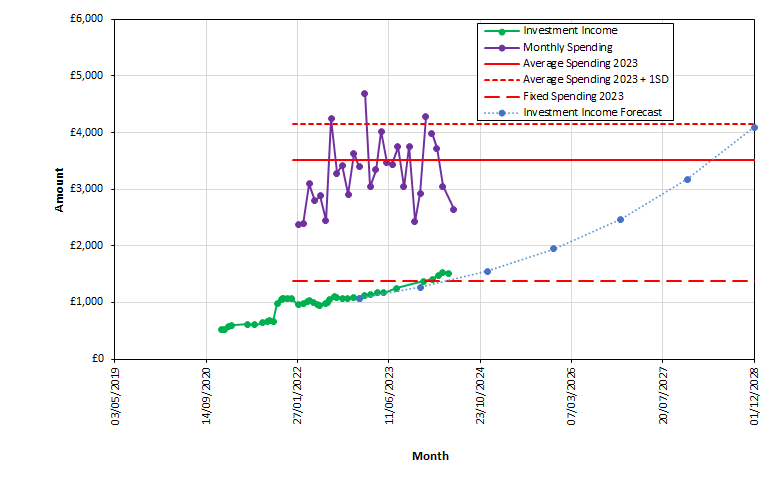

Inspired by the Mad Fientist, we track our net worth slightly differently. This helps us visualise the trajectory towards FIRE based on current monthly spending and investing habits.

The graph has the following assumptions:

Income from investments (post-FIRE) = 4%

Monthly savings / investments = £3,000 per month

Return on investments (pre-FIRE) = 7%

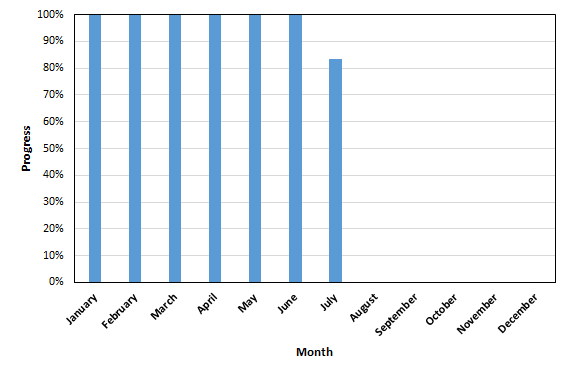

Also, as another way of looking at it, we break our FI milestone (an arbitrary £800,000) into 12 equal bars to track our progress against that. Each bar indicatively represents achieving financial freedom for each representative month of the year. Therefore, we are currently sitting at 6.8 months of financial independence each year.